“Succession” is over, but spoiled, entitled billionaire man-children are still very much with us, running social media companies, owning newspapers and television networks, and funding politicians and judges who then keep their taxes low and regulations minimal.

America’s billionaires (and soon to be trillionaires) pay an average of around 3.1 percent as their functional income tax rate; as a result, America is the most unequal developed society in the world. The last time severe poverty and extravagant wealth coexisted in such extremes as today in this country was during the 1920s and 1930s.

Today we read about roving gangs doing smash-and-grab operations against retailers like Nordstroms and Home Depot; in Red states our schools are falling apart, defunded to pay for vouchers to all-white “Christian” academies; gun violence plagues our nation with particularly high homicide rates in rural Red states; and homelessness stalks city-dwellers at every turn.

The last time we saw the consequences of such inequality was during the Republican “Roaring ‘20s” 100 years ago, when Warren Harding dropped the top income tax rate from 91 percent to 25 percent, the morbidly rich openly bought our politicians, and gangs whose names are still known today roamed the country robbing and killing with impunity.

FDR created America’s first widespread middle class with a combination of high taxes on the rich and strong unions for working class people. He broke the politically corrupt power of organized wealth for two generations.

Franklin D. Roosevelt’s New Deal put an end to all that, and we need to repeat his example today.

FDR raised the top income tax bracket from 25 to 90 percent. Wealthy people in America screamed and yelled, claiming it would crash the economy, but instead that top tax rate kicked off the first middle class to encompass more than half a nation’s population in world history.

As Roosevelt noted in 1936:

“A number of my friends who belong in the very high upper brackets have suggested to me on several occasions of late, that if I am reelected president, they will have to move to some other nation because of high taxes here.

“Now, I will miss them very much...” (audience breaks into laughter)

FDR created America’s first widespread middle class with a combination of high taxes on the rich and strong unions for working class people. He broke the politically corrupt power of organized wealth for two generations.

Abraham Lincoln was the first president to use the word unions to describe labor organizations; it was such a novelty that newspapers of the day put the word in quotation marks. By the 1920s the union movement had seized the nation, but employers and Republican politicians were still using police, the army, and private armed militias to kill union leaders and intimidate people who wanted to join them.

Franklin Roosevelt put an end to that with the Wagner Act in 1935, fully legalizing unions. By the time Reagan took office in 1981 about a third of Americans had a good union job, and as a result fully two-thirds of American workers had union-level wages and benefits (because unions created the local wage and benefit floor for employers).

The people who were obscenely rich throughout the era from the 1930s to the 1980s had mostly inherited their money from their 19th century Gilded Age ancestors (the Rockefellers, Vanderbilts, DuPonts, Carnegies, etc.), because the combination of the 90 percent income tax bracket and union demands for meaningful wages kept inequality at reasonable levels.

Rich people were still rich, but that top income tax bracket combined with the power of unions kept the average CEO from taking much more than 30 times what their lowest-paid worker made every year. (Today, some CEOs make more than a thousand times what their workers make.)

Reagan wasn’t alone in destroying the American Dream... He had big-time help from the nation’s highest court.

FDR’s and LBJ’s social safety nets caught Americans before they could fall into the dire poverty that characterized earlier eras when Republicans ran the show. Social Security and unemployment benefits — both rolled out by FDR in the 1930s — lifted the elderly and the jobless out of poverty, and LBJ’s Medicare and Medicaid (1960s) kept Americans healthy.

The result of this was that crime went down and lifespans increased. When the grinding inequality of the Roaring ‘20s and the Republican Great Depression went away in the 1940s and 1950s, the crime sprees and hate-promoting demagogues went with it. Working people with decent wages and benefits, after all, have neither the time nor the need to engage in criminal activity.

Corporate executives lived and worked in normal — albeit upscale — neighborhoods (watch an episode of Bewitched or The Dick Van Dyke Show from the 1960s to see the homes Madison Avenue executives and media bigwigs lived in), and workers made enough to sustain a decent lifestyle.

Nonetheless, the morbidly rich campaigned relentlessly to take us back to the oligarchic 1920s, demanding tax cuts and union-busting. They funded media campaigns, think tanks, publications, judges and politicians.

In 1981 they got their guy into office; Reagan dropped the top tax rate all the way down to 27 percent and destroyed the nation’s air traffic controllers union as his opening salvo in the modern-day Republican War Against Workers.

Reaganism kicked off a 42-year-long explosion of wealth at the very top of our economic hierarchy, making today’s billionaires richer than the pharaohs. They compete with each other to see who can own the largest private jets and mega-yachts, multiple mansions all over the world, private islands, and even their own spaceships.

Disney’s old Scrooge McDuck comics (that I’m now reading to my grandkids) and their unfathomable money bins have come to life.

Simultaneously, the middle class began its collapse from two-thirds of us in 1980 all the way down to today’s 45 percent (and today it takes two incomes to sustain the same middle class lifestyle that could be done with just one when Jimmy Carter was president).

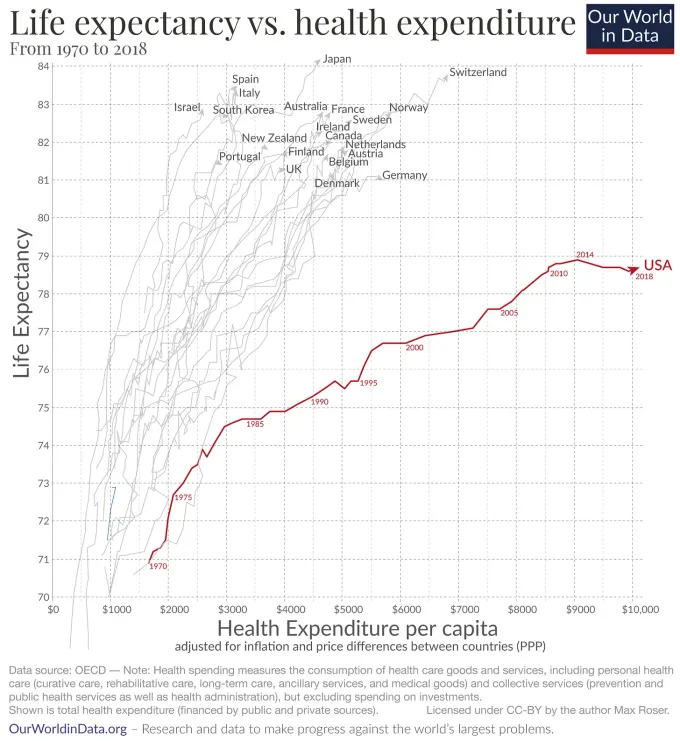

As the middle class collapsed, lifespans in America followed the same trajectory, unlike other countries in the world that rejected Reaganomics.

Reagan wasn’t alone in destroying the American Dream, however. He had big-time help from the nation’s highest court.

Five Republican appointees on the Supreme Court initiated the process with their First National Bank decision in 1978, which said that billionaire and corporate money wasn’t money but instead was a form of “free speech” and that corporations weren’t a legal fiction but instead were “persons” with full rights under the Bill of Rights, including the right to use their “free speech” to own politicians.

That decision, authored by the infamous Lewis Powell himself, made possible the purchase of the Republican Party by the morbidly rich in 1979, floating Reagan into office in 1980 on a tsunami of corporate and billionaire (in today’s dollars) cash, much of it from the oil and banking industries.

Reagan then rewarded the GOP’s affluent paymasters with lower taxes, more tax-code loopholes, and a campaign of massive industrial and banking deregulation, giving particular preference via his EPA Administrator — the disgraced Anne Gorsuch (Neil’s mom) — to fossil fuel and other polluting industries.

We must gather and gain the political strength and will to once again raise the top income tax rate up to 90 percent; to overturn the Taft-Hartley Act and restore the right to unionize without interference; and to strip the poison of big money out of our political system.

So, here we are in a situation much like the one that FDR faced when he first came into office in 1933. Homelessness stalks the nation; three morbidly rich individuals own more wealth than the bottom half of Americans; gun crime is at Bonnie and Clyde levels; and workers are terrified of their employers, who force them to sit through anti-union indoctrination sessions or lose their jobs.

To solve this crisis, we must gather and gain the political strength and will to once again raise the top income tax rate up to 90 percent; to overturn the Taft-Hartley Act and restore the right to unionize without interference; and to strip the poison of big money out of our political system.

The morbidly rich will squeal at even the mention of these tried-and-tested solutions, just like they did in the 1930s. They’ll warn that the country will collapse, or that communism will take us over and we’ll become Venezuela or Cuba. They’ll say that the “job creators” will go on strike like in an Ayn Rand novel and take the economy with them to Gault’s Gulch.

And, like FDR, we need to call them on their bullsh*t.

As President Roosevelt once told America:

“In 1776 the fight was for democracy in taxation. In 1936 that is still the fight. Mr. Justice Oliver Wendell Holmes once said: ‘Taxes are the price we pay for civilized society.’ One sure way to determine the social conscience of a government is to examine the way taxes are collected and how they are spent. And one sure way to determine the social conscience of an individual is to get his tax-reaction.”

Roosevelt noted that as society became more modern and complex, the demands on government increased along with the need to pay for its services through taxes. The need for our commons had expanded as our population and our technologies grew.

“But,” he noted, “I am afraid we have many who still do not recognize their advantages and want to avoid paying their dues.

“It is only in the past two generations that most local communities have paved and lighted their streets, put in town sewers, provided town water supplies, organized fire departments, established high schools and public libraries, created parks and playgrounds—undertaken, in short, all kinds of necessary new activities which, perforce, had to be paid for out of taxes.”

He framed the need to raise taxes on the morbidly rich into the 90 percent region (between 1932 and 1936 he cut income taxes on people making less than $50,000 a year) as a patriotic thing to do.

It was, Roosevelt claimed, in the finest of American traditions:

“Ever since 1776 that struggle has been between two forces. On the one hand, there has been the vast majority of our citizens who believed that the benefits of democracy should be extended and who were willing to pay their fair share to extend them. On the other hand, there has been a small, but powerful group which has fought the extension of those benefits, because it did not want to pay a fair share of their cost.”

And that small but powerful group had more than their share of front men back then — the Fox “News” hosts of that day — who claimed that giving workers power, or raising taxes on the morbidly rich, was somehow against the natural order of things. That it would “distort” the nation’s economy and end CEOs ability to run their businesses, leading to either communism or economic disaster.

Again, FDR took the truth right to them:

“You would think, to hear some people talk, that those good people who live at the top of our economic pyramid are being taxed into rags and tatters. What is the fact? The fact is that they are much farther away from the poorhouse than they were in 1932. You and I know that as a matter of personal observation.”

Like today, there were Republican politicians and media commentators who warned about a “welfare nanny state” and predicted that if people weren’t kept in near-poverty they’d lose their incentive to work.

Like today, it was a lie. And FDR called it out:

“Once more this year we must choose between democracy in taxation and special privilege in taxation. Are you willing to turn the control of the nation’s taxes back to special privilege? I know the American answer to that question. Your pay envelope may be loaded with suggestions of fear, and your dividend letter may be filled with propaganda. But the American people will be neither bluffed nor bludgeoned.”

Republicans act like raising taxes on the morbidly rich, enforcing anti-monopoly laws, returning the right to unionize to workers, and ending the “right” of billionaires and corporations to buy politicians and Supreme Court judges is some sort of radical, untried experiment that will ruin our nation.

It’s a lie. When you tax billionaires at 90 percent, they’re still fabulously rich and you have the resources to rebuild a healthy and happy middle class across the nation.

We did it before, and the result was the creation of the world’s first and largest middle class, a life expectancy never before seen in all of history, and a level of peace and prosperity that held its own until Ronald Reagan took a meat-axe to it.

We can do it again. If we want to preserve our democracy, in fact, we must do it again.

This may be our last chance to wake our nation up before the oligarchic takeover is complete. It’s time for all of us to emulate Paul Revere — and Franklin D. Roosevelt — and tell our friends and neighbors of both the threats we face and the promise that our nation once embraced and can again achieve.